Merger control: new “green” considerations

Sustainable development issues also apply to merger control, which ensures in particular that mergers between competitors do not impair innovation. Indeed, by ensuring that mergers do not harm competition, the Autorité safeguards and encourages innovation, so that companies continue to develop new technologies, new know-how or better products that lead to environmental and sustainable improvements.

In terms of merger control, defining the relevant markets is an essential step, insofar as this makes it possible to identify the scope within which competition between companies takes place and to assess, in a second stage, the respective market powers of the players involved. As part of the examination of transactions submitted to it, the Autorité is increasingly called to define and examine what are known as new “green” markets.

Examination of the transaction relating to the stake acquired by Storengy, a subsidiary of Engie, in DMSE

For example, during the examination of the transaction relating to the stake acquired by Storengy, a subsidiary of Engie, in DMSE, the Autorité examined, for the first time in January 2021, the markets for the production and distribution of hydrogen, as well as the market for the development, construction and installation of hydrogen stations. The Autorité considered that although, after the transaction, DMSE would be the only operator active on the hydrogen distribution market in the Dijon area, this position was not necessarily problematic, given the emerging and rapidly expanding nature of the market. Taking into account the existence of potential competitors and the absence of barriers to entry on this market, it considered that this situation did not raise competition concerns.

Furthermore, given the importance of electricity in the process of producing hydrogen by electrolysis, the Autorité also assessed the effects of the transaction on the market for the retail supply of electricity. In this framework, it questioned the need to identify a separate segment for the retail supply of “green electricity”, grouping together the green electricity offerings that rely on electricity generated from renewable sources or covered by guarantee of origin certificates. In this regard, the Autorité noted the growing development of these offerings, which are primarily based on the system of guarantee of origin certificates and on the increasing demand from consumers (companies, local authorities and individuals). In light of these factors, the Autorité found that there was less substitutability between the retail supply of green electricity and that of traditional electricity, a finding that seems to suggest the existence of a specific market for the retail supply of green electricity.

Nevertheless, the Autorité decided to leave this question open at this stage, as the competitive analysis remained unchanged, regardless of the segmentation applied. At the end of its analysis, the Autorité therefore cleared this transaction without imposing any specific conditions.

Examination of the creation of the GMOB joint venture by AGI, EDF PEI, Genak and SAFO

In October 2021, the Autorité examined the creation of the GMOB joint venture by AGI, EDF PEI, Genak and SAFO, which planned to operate in the sector of public charging stations for electric vehicles in Guadeloupe and, in a second phase, in Martinique and French Guiana. On this occasion, the Autorité examined, for the first time, the upstream market for the supply of electric vehicle charging points and the downstream market for the installation and operation of electric vehicle charging points. At the end of its analysis, the Autorité therefore cleared this transaction without imposing any specific conditions.

Consumer preferences for sustainable products have also already been taken into account in the agrifood sector (Carrefour/Bio c’ Bon)

For example, in Decision 21-DCC-161 of 10 September 2021 clearing the takeover by Carrefour of 100 Bio c’ Bon stores, subject to conditions, the Autorité identified the existence of (i) an upstream market for the supply of organic products and (ii) a downstream market for the retail distribution of organic products. Upstream, the Autorité noted the specific nature of the supply distribution channel for organic products to mass-market food retailers specialising in the distribution of organic products (“GSS”). Downstream, the Autorité considered that conventional and organic products were not substitutable in the eyes of consumers and that generalist mass-market food retailers (“GSA”) were not a substitute for GSS from the point of view of GSS customers.

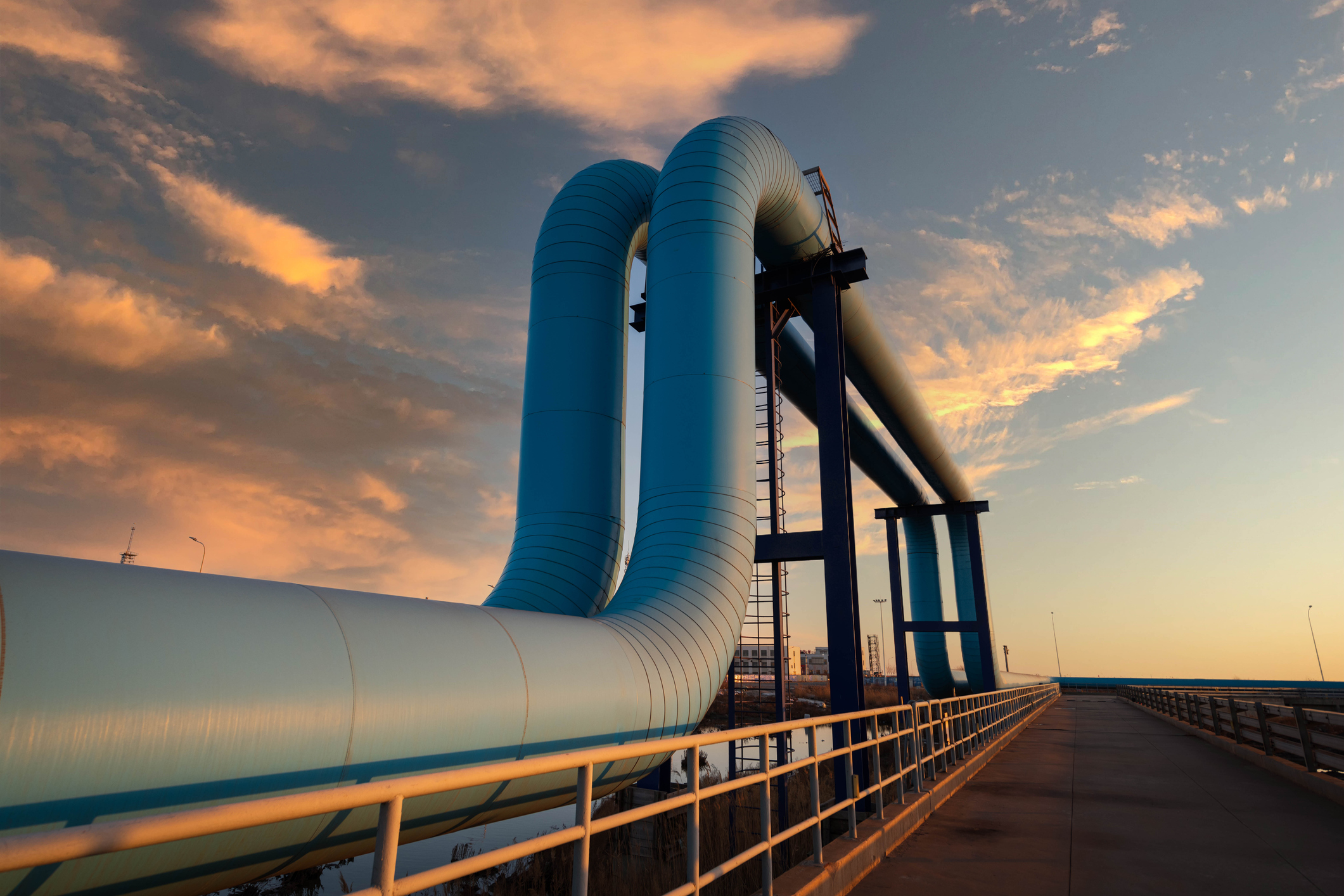

Proposed acquisition by the Ardian group of Société du Pipeline Méditerranée-Rhône (SPMR)

Lastly, in May 2021, the Autorité adopted a decision to block the proposed acquisition by the Ardian group, which is active in the transport, telecoms and renewable energy sectors, of Société du Pipeline Méditerranée-Rhône (SPMR), which is active in the transport of hydrocarbons through pipelines. Among other things, the Ardian group claimed that it would steer the target’s commercial policy in the direction of energy transition and that this “gain” was specific to the planned merger. While the Autorité rejected this analysis given the facts of the case, it nevertheless clarified that environmental gains could, in theory, be admissible to counterbalance the risks of harm to competition associated with a merger.